If you’re a SaaS company trying to get Stripe subscription data into HubSpot, the first place you probably land is HubSpot’s free Stripe Data Sync app.

It appears promising: Free. Easy. Tightly integrated. Powered by HubSpot itself.

But if you’ve already tried using it to report on MRR, build lifecycle automation, or get a full picture of who’s paying you what, you’ve probably discovered the gap between expectation and reality.

In this post, we’ll walk through:

What HubSpot Stripe Data Sync actually does

What data you really get back (with examples)

Why SaaS teams outgrow the free app

Where it’s genuinely useful

What a “grown-up” Stripe → HubSpot setup looks like

And how tools like ClearSync (hi 👋) fit into the picture

We’ll be opinionated, but fair. And we’ll embed our full data teardown video so you can see real examples for yourself.

Let’s get into it.

What HubSpot's Stripe Data Sync App is

At a high level, HubSpot’s Stripe Data Sync app is a free, officially supported HubSpot Marketplace app. It’s built on HubSpot’s Data Sync engine and designed to move data between Stripe and HubSpot with minimal setup.

It is not designed to transform Stripe’s subscription data to be useful for SaaS MRR reporting.

It syncs five types of Stripe records:

Subscriptions

Payment Transactions

Invoices

Products

Customers

But each of those maps only to specific HubSpot objects, and that matters more than most teams realize.

Our docs go extremely deep into the configuration (you can read our full guide here), so this post focuses instead on what you get once everything is connected and where the value stops.

What You Actually Get When You Sync Stripe to HubSpot

Below is a breakdown of each object: what comes through, what’s missing, and why it matters.

1. Stripe Subscriptions → HubSpot Custom Object

Data Sync requires you to create your own custom object for subscriptions; you cannot sync the data to the built-in HubSpot Subscription object. This limits the usage to only users of HubSpot Enterprise, since they’re the only ones who can create custom objects in HubSpot.

Once you do, this is what comes through:

Subscription ID

Subscription status

Currency

Subscription start date

Subscription current period end

Relates to existing contacts if they exist in HubSpot, using the Stripe billing email address

What you don’t get:

❌ Current MRR

❌ Current quantity

❌ Product names

❌ Any historical subscription changes

❌ Billing cycle details

❌ Associations to invoices or payments

❌ Associations to Companies (without extra automation)

This is where most SaaS teams hit the wall.

If you sell recurring revenue, the single most important field is current MRR, and that field simply doesn’t exist in Data Sync.

So you’re left with a subscription object that tells you something happened, but not what it’s worth today.

2. Payment Transactions → HubSpot Custom Object

Similar story to Subscriptions: to see your payments from Stripe in HubSpot you need another custom object; you cannot sync the data to the HubSpot Payments object. Once again, this limits the usage to only users of HubSpot Enterprise.

What comes through:

Amount charged

Currency

Payment method (just whether card present or not - no last 4 digits)

Event context (“subscription created”, “subscription updated”)

What you don’t get:

❌ Last 4 digits or card expiration

❌ Billing address

❌ Subscription ID (so you can’t associate the payment back to the subscription)

❌ Any revenue fields you actually want (MRR, ARR)

❌ Separation between recurring vs one-time charges

❌ A Stripe subscription ID, so we can’t relate the payment record to the subscription record easily

For example, when we upgraded a $1/month subscription to two seats:

Stripe recorded the change as $1 extra MRR

Data Sync recorded it as a $0.97 prorated payment instead of the change in MRR, which would have been $1.

That makes sense from wanting to see raw payment information, but not from an MRR reporting perspective.

If you try to run expansion, contraction, or upgrade reporting this way, it becomes a mess almost immediately.

3. Invoices → HubSpot Invoice Object

Invoices are actually where Data Sync shines. The Data Sync app syncs Stripe invoices to the built-in HubSpot Invoices object for you.

If you want to see how much a customer paid on their invoices over time, this is what the app is built to do. If you want to see that translated to MRR (accounting for things like prorations, one-time payments, discounts, free trials, etc), you will have to jump through your own hoops to calculate it yourself.

What comes through:

Invoice amount

Amount paid

Customer info

Billing / shipping address

Period start & end dates

Product line items

Invoice status

Invoices also automatically associate back to Contacts (and therefore the Company the Contact is related to in HubSpot), which is great.

But the major limitations:

❌ Invoice line item amounts don’t always reflect discounts

In our test, a $10 plan discounted to $1 still showed as $10 in HubSpot

❌ Invoices can’t be associated to custom objects

❌ Invoices don’t represent actual MRR in SaaS businesses. Oftentimes an invoice can represent a prorated amount, coupons, and one-time payments, that shouldn’t be counted towards recurring revenue.

So this object is solid for invoice-level reporting, but disconnected from everything else that matters in a reporting on MRR in a SaaS motion.

4. Products → HubSpot Products Object

The Data Sync app syncs Stripe products to the built-in HubSpot Products object for you. Products sync cleanly.

You’ll get:

Product name

Stripe product ID

Unit price

Pricing model (flat, tiered, graduated, etc.)

This is useful for seeing more context on line items in the invoice.

5. Customers → HubSpot Contacts Object

Stripe billing email maps to HubSpot contacts. But the Data Sync app can only sync to the HubSpot Contact object, it cannot sync to the HubSpot Company object. When you sync them,

What comes through:

Stripe customer ID

Billing email

Some address fields

Some metadata

Basic customer details

You don’t get:

❌ Any recurring revenue values

❌ Insights about plan, subscription value, or lifetime value

❌ Coupon fields (even when the customer has discounts)

❌ A clear “company vs person” distinction (Stripe doesn’t make one)

Most SaaS teams end up building roll-ups from invoices because Data Sync doesn’t give you a subscription-level revenue number.

This works in a pinch, but it’s not recurring revenue, you’re really just summing invoice totals.

Who HubSpot Stripe Data Sync is actually good for

To be fair, Data Sync is valuable, just not for subscription reporting.

It’s a good fit if:

You want free invoice sync

You only need to see invoice statuses (paid, open, uncollectible)

You don’t care about reporting on MRR/ARR

You don’t run a SaaS business

You don’t need upgrade/downgrade reporting

You don’t need RevOps automation based on revenue changes

You have HubSpot Enterprise or HubSpot Data Hub Starter+ to sync all of the available fields and objects

If this is you, the free app is solid.

But if you’re a recurring revenue business with any complexity at all, you’ll hit the limitations quickly.

Where Data Sync Breaks for SaaS (The Big Problems)

Here are the issues that matter most for SaaS teams:

1. No MRR or ARR fields anywhere

The number one thing every SaaS business needs is missing.

2. No subscription change history

No new → upgrade → downgrade → churn sequence for subscriptions. The HubSpot Data Sync app simply shows the current state of the subscription’s latest invoice.

3. No linking between the objects

You can’t associate:

A payment → the subscription it came from

A subscription → the company it belongs to

A subscription → its invoices

An invoice → the subscription that generated it

This makes reporting and automation nearly impossible.

4. Proration & one-off charges ruin MRR reporting

Stripe’s payment objects don’t distinguish recurring vs one-time revenue. Data Sync doesn’t fix that. This is important if you care about reporting on MRR, which shouldn’t take one-time payments or prorated invoices into account.

5. Full Access Requires HubSpot Enterprise and Data Hub Starter+

If you need to sync to subscriptions and payments objects in HubSpot, that means you need custom objects. Custom objects means you need HubSpot Enterprise. Many custom fields means you might need HubSpot Data Hub Starter+.

To get all of these things, that free app suddenly gets expensive.

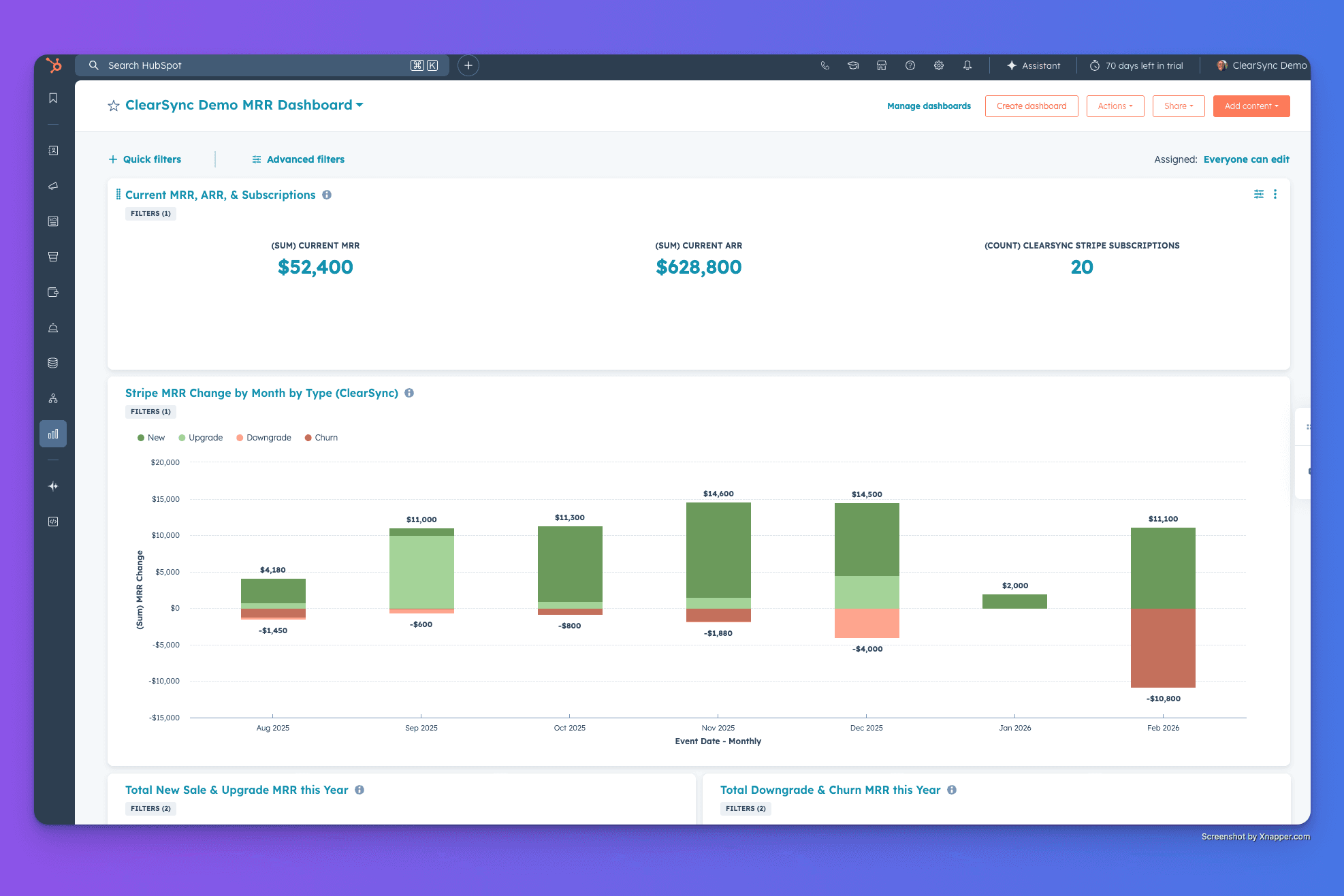

What a “grown-up” Stripe → HubSpot setup looks like for recurring revenue teams

If you’re serious about recurring revenue, here’s the model that actually works:

1. A real Subscription object with actual revenue fields

Current MRR

Product name(s)

Previous & current product quantity

Renewal date

Billing interval length

Subscription status

Current period start & end dates

Stripe Subscription and customer IDs

2. An Event object for every MRR change

New

Upgrade

Downgrade

Churn

That contain important information about every MRR change:

Current & previous MRR

MRR change

MRR event status (plan change, price change, quantity change)

Previous & current quantity (if you have seat-based pricing or sell multiple quantities of each product)

Billing interval

Product name(s)

If these are clear, timestamped, and reportable, then you can break down all of your revenue numbers by customer and see your MRR over time and by product directly in HubSpot.

3. Proper associations between Objects

Importantly, you need HubSpot Companies and Contacts related to Stripe Subscriptions and MRR Events

This is how you get:

MRR reporting over time, by customer or product or type (upgrade, downgrade, new, churn)

Expansion vs contraction reporting

Customer-level LTV

GTM-based Workflows that you can run upsell & downgrade campaigns for

Internal alerts when things change

And tons more

4. Clean, normalized Stripe data

Stripe’s raw objects are almost too flexible, so you need a layer that converts them into consistent MRR truth. The math behind that can be tough, but this is exactly what tools like ClearSync are built for.

Alternatives: HubSpot Stripe Data Sync vs ClearSync vs Others

A quick, fair comparison:

HubSpot Stripe Data Sync

Best for:

Invoice visibility in HubSpot

Viewing basic payment data

Free sync of customer & product data from Stripe to HubSpot

Not for:

Reporting on MRR or ARR

Subscription reporting

Subscription teams, like PLG or Sales-led teams selling SaaS

RevOps automation

ClearSync

Best for:

Accurate MRR math (including mid-period proration, discounts, one-time sales, and multi-line items)

Full Stripe subscription history

Granular MRR change events for each Stripe subscription

Company and contact association with your Stripe data

Clean revenue dashboards

RevOps automation based on revenue signals

ClearSync also works with all HubSpot editions, without Data Hub Starter, and with full historical backfill and real-time sync.

Other choices

Building your own with your data warehouse + Reverse ETL

Watch: Our 6-Min Teardown of HubSpot's Stripe Data Sync App

See real synced records and all the limitations in action.

If You Want Accurate MRR in HubSpot

Data Sync is great for what it is: a free connector.

But if you rely on recurring revenue to run your company, report to investors, or operate a PLG funnel, you’ll want something more purpose-built.

That’s why we built ClearSync.

We handle the tricky parts (MRR math, subscription history, multi-line items, proration, revenue intelligence) and sync clean, usable subscription data into HubSpot automatically.

If you want to see what a robust Stripe → HubSpot integration for SaaS businesses looks like start a free trial of ClearSync or get in touch. We're happy to chat!