If you’re running a SaaS business that uses HubSpot and Stripe, you’ve probably had this thought at least once: “Should we just do billing inside HubSpot instead of Stripe?”

It’s a great question because the landscape is confusing! There aren’t just two choices (Stripe vs HubSpot), there are actually three completely different billing setups that all involve Stripe in some way:

Stripe Billing (Stripe owns the subscription)

HubSpot Payments (HubSpot owns the subscription and payments)

Using Stripe as a payment processor in HubSpot (HubSpot owns the subscription, Stripe runs the payment)

Each one stores data differently, handles renewals differently, and has very different implications for your MRR reporting, RevOps workflows, and customer lifecycle visibility.

You might want to compare HubSpot Payments vs Stripe Billing based on things like transaction fees, number of available payment methods, invoicing flexibility, and ACH limits. But when you pick a billing system, you’re also picking:

where your subscription “source of truth” will live

how upgrades/downgrades/cancellations get tracked

the level of complexity of your billing model

how MRR/ARR gets calculated

what your CRM can see (or not see)

the quality of your renewal automation and RevOps workflows

So let’s get into it.

The Three Options: Stripe Billing, HubSpot Payments, and Stripe as a Payment Processor in HubSpot

1. Stripe Billing

These are what you think of when you think of Stripe: Stripe’s subscription & invoicing engine. It’s core to their product offering. It can handle any number of incredibly complicated pricing models and needs for most types of businesses. It’s often a go-to for startups since it’s built for engineers to get payments up and running quickly with a ton of flexibility. When you’re using Stripe Billing, when a subscription is created, changes, or renews, Stripe knows. HubSpot does not.

Who owns the subscription? Stripe

Who owns lifecycle events (renew, upgrade, cancel)? Stripe

Who sees everything? Stripe

Who sees almost nothing unless you sync it in? HubSpot

Pricing

Stripe fees vary, but are generally:

Stripe Payments: 2.9% + $0.30 per credit card transaction and 0.8% for ACH debit (capped at $5)

Stripe Billing (subscription features): 0.7% per transaction; or you can pay monthly starting at $620/mo if you lock in for a year

Invoicing: 0.4% per paid invoice

$15 chargeback dispute fee

Key takeaway

Stripe Billing is extremely powerful, but Stripe does not sync to HubSpot natively. If you want HubSpot to know what’s happening with your revenue and customers from Stripe, you need an integration.

(We’ll show your options later, or you can dig into this article about all the options for syncing Stripe data to HubSpot.)

2. HubSpot Payments

HubSpot Payments lives inside Commerce Hub and is ideal for clean revenue reporting inside HubSpot, tying quotes + subscriptions + deals + reporting together, and sales-assisted recurring revenue. In November 2025, HubSpot introduced tiered pricing, giving you more options than just flat-rate billing, which is critical for many SaaS businesses.

If a subscription renews or changes, HubSpot creates the next invoice, updates the subscription, and can trigger workflows and reporting off of subscription data.

Stripe only sees the charge; a Subscription is not created in Stripe. You will see no subscription data in Stripe if you’re using HubSpot payments.

Who owns the subscription? HubSpot

Who owns lifecycle events (renew, upgrade, cancel)? HubSpot

Who processes the card? Stripe (quietly, behind the scenes)

Who sees everything? HubSpot

Does Stripe create a subscription in Stripe itself? No

Pricing

HubSpot Payments aims to be cheaper than Stripe. The fees are:

2.9% per credit card transaction (no $0.30 fixed fee like Stripe)

Platform fee: 0.5% per transaction

No chargeback dispute fees (compared to $15 like Stripe)

Invoicing: included (compared to 0.4% per paid invoice for Stripe)

ACH fees: 0.8% per transaction, capped at $10 (higher than Stripe’s cap)

HubSpot Payments does have a few limitations today:

fewer payment methods than Stripe (aka you cannot have your customers pay with methods like Klarna)

only for businesses running in the US, UK, and Canada

HubSpot is adding more complex billing features but is still not comparable to Stripe Billing for usage-based or deeply complex SaaS scenarios

must be using a paid version of HubSpot

cannot use both Stripe-as-a-processor and HubSpot Payments in the same HubSpot portal

HubSpot lacks different international payment methods like SEPA, iDEAL, FPX

HubSpot Commerce APIs and Integrations are much more limited than Stripe's

Key takeaway

HubSpot becomes the source of truth for everything about your subscriptions. Stripe is just the payment rail.

3. Using Stripe as a Payment Processor in HubSpot

This setup is useful for teams who want HubSpot-native subscriptions and who already have Stripe Payments but don’t want to migrate to HubSpot Commerce Hub. This is also available to HubSpot users on a free HubSpot plan. This feels like “I’m using Stripe inside HubSpot,” but it is NOT Stripe Billing, which is the most important point.

In this case, HubSpot creates the subscription. Stripe just processes the card. You will no longer see the subscription in Stripe if you use Stripe as a payment processor in HubSpot.

Who owns the subscription? HubSpot

Who processes the charge? Stripe

Who sees all subscription data? HubSpot

Does Stripe create a subscription in Stripe itself? No

Pricing

Fees are the same as standard Stripe:

Stripe Payments: 2.9% + $0.30 per credit card transaction and 0.8% for ACH

Stripe Billing (subscription features): 0.7% per transaction; or you can pay monthly starting at $620/mo if you lock in for a year. This only applies if you have this feature turned on in Stripe, which may not make sense to have on since HubSpot is creating the subscription, not Stripe.

Invoicing: 0.4% per paid invoice

$15 chargeback dispute fee

Key takeaway

You pay Stripe’s normal payment processing fees, but you do not get Stripe Billing functionality. In most cases, Stripe Billing fees do not apply because HubSpot is creating the subscription, not Stripe Billing. HubSpot becomes your billing and subscription engine.

The Quick Overview

How the data flows, and where the truth lives.

Setup | Subscription Lives In | Lifecycle Events Live In | MRR Truth | Invoices | Subscription Visibility in HubSpot CRM |

|---|---|---|---|---|---|

Stripe Billing | Stripe | Stripe | Stripe | Stripe | ❌ unless you sync |

HubSpot Payments | HubSpot | HubSpot | HubSpot | HubSpot | ✔ natively in HubSpot Subscriptions |

Stripe as payment processor in HubSpot | HubSpot | HubSpot | HubSpot | HubSpot | ✔ natively in HubSpot Subscriptions |

Or, the simple metaphor:

Stripe Billing: Stripe is the brain. HubSpot doesn’t know anything unless you tell it.

HubSpot Payments: HubSpot is the brain. Stripe is the credit card terminal.

Stripe as a payment processor in HubSpot: HubSpot is the brain. Stripe is the credit card terminal (but you still pay Stripe fees).

Migrating between platforms

What if I have HubSpot Payments and want to move to Stripe?

There’s not a ton of information about this online, but we did some digging, and migration is an option. HubSpot supports migrating payment method tokens bi-directionally between Stripe direct accounts and HubSpot payment accounts.

The HubSpot subscriptions cannot be automatically migrated into Stripe. HubSpot can request that Stripe process a copy of payment method tokens from their current HubSpot payments account to a new Stripe account, but those would just come over as a file of payment methods and customers (email addresses). Customers need to spin up all new subscriptions in Stripe directly and then attach the payment methods to use them.

What if I have Stripe and want to move to HubSpot Payments?

That is also an option. Keep in mind that unless you work with HubSpot to migrate your Stripe subscriptions to HubSpot, your subscription data will live in Stripe until the day that you cut over.

HubSpot has a form to help migrate customers from Stripe to HubSpot, and it’s not super clear what data comes along with this migration. It may be the same story as above when migrating from HubSpot payments to Stripe.

If You Use Stripe Billing, How Does Data Get Into HubSpot?

If you’re using HubSpot for your CRM and Stripe Billing for your subscription management, HubSpot won’t automatically see any of your Stripe data within the CRM unless you connect them together yourself. If you don’t do this, you won’t be able to see SaaS metrics like your current MRR, subscription renewal dates, expansion/contraction, churn, and historical subscription data alongside all your customer data in the HubSpot CRM.

This is super important if you want to join your CRM and revenue data, which is critical for understanding your business metrics and customer health. (Which is why HubSpot is creating all these billing and payment tools - it ties the revenue data directly into the CRM for you.)

To give HubSpot visibility into your Stripe data, you have a few options (and we discuss them in depth here!):

1. HubSpot's Stripe Data Sync App (free)

We have an in-depth article and video about the HubSpot Stripe Data Sync app and what data it can push to HubSpot. It’s great if you want to only see raw payment data in HubSpot, but not great if you want to report on your business metrics like MRR and churn.

✔ Syncs customers, invoices, payments

❌ No subscription objects

❌ No lifecycle events

❌ No MRR

❌ No renewal visibility

This is good if you only care about seeing raw payments inside of HubSpot.

2. ClearSync (paid, lifecycle-focused)

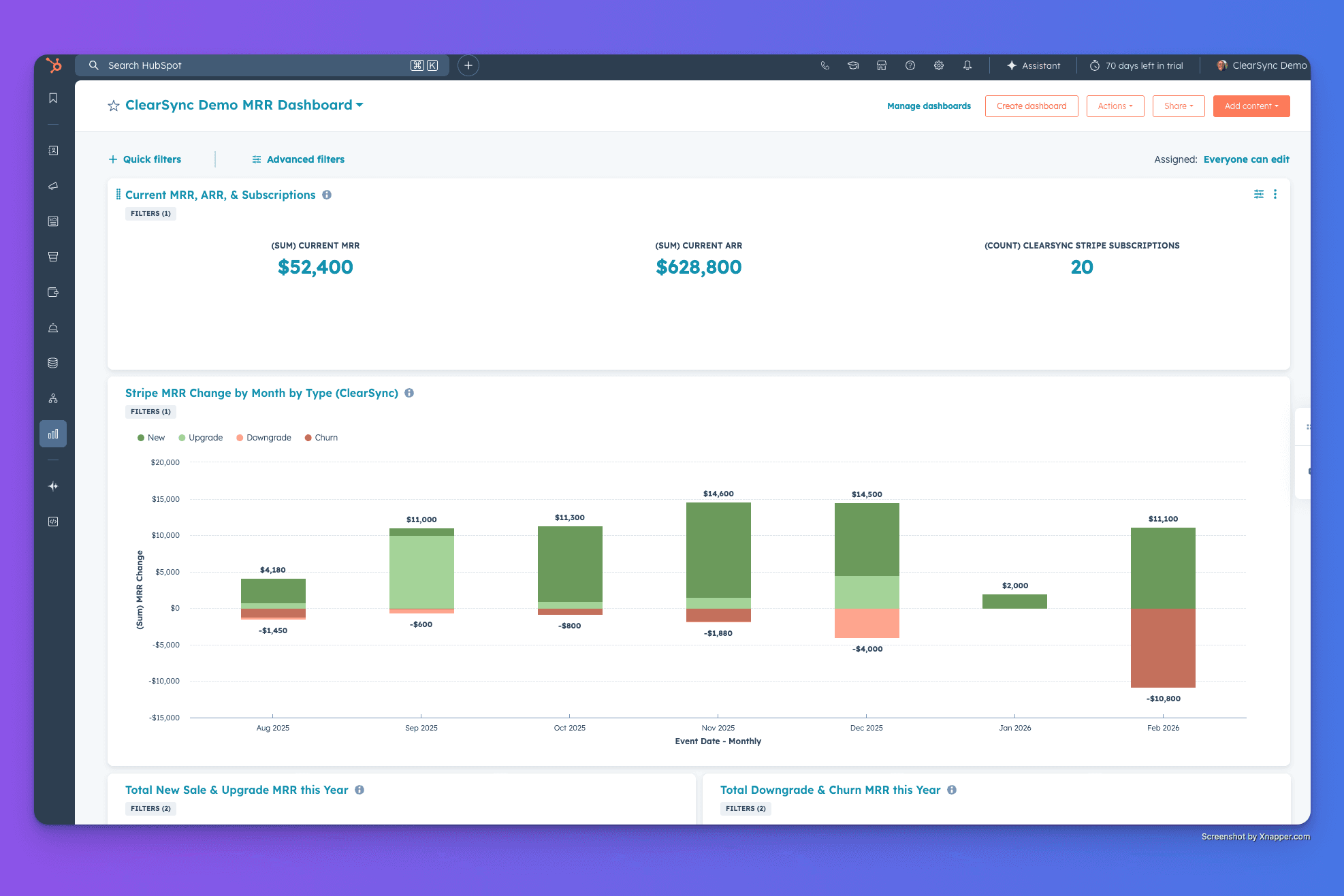

ClearSync (hi!) retrieves and normalizes Stripe lifecycle events (upgrades, downgrades, cancellations, renewals, usage changes) into HubSpot’s CRM using custom subscription + event objects.

This gives RevOps and GTM teams accurate MRR, renewal dates, and lifecycle activity directly inside HubSpot.

We build this tool because we believe there needed to be a better solution for the “Stripe Billing → HubSpot visibility gap,” which HubSpot and Stripe don’t solve out of the box.

3. Build It Yourself

You can absolutely build your own Stripe to HubSpot sync. Plenty of teams do this when they have strong engineering resources and very specific needs.

Here’s the honest version of what that entails:

You’ll need to calculate MRR/ARR correctly, including edge cases like tiered pricing, quantity changes, prorations, discounts, credits, coupons, free trials, partial periods, and one-time fees.

You’ll need to pull Stripe events, decide which ones matter, and design your own mapping logic.

You’ll need to decide whether you want to import all historical Stripe data (and reconcile it), or only go forward.

You’ll need to build custom objects, rollups, associations, and workflows inside HubSpot.

And you’ll need to maintain it as your billing model evolves and Stripe updates its APIs.

It’s definitely doable, but it’s not a weekend project, and you’ll be the one supporting it long-term.

Final Thoughts

Choosing a billing system isn’t really a question of “Stripe vs HubSpot”, it’s a question of where your revenue truth should live and how much complexity your business needs.

If you use Stripe Billing, you’re choosing the most powerful subscription engine available. But to make it work inside HubSpot, you’ll need a lifecycle-aware integration so your CRM sees upgrades, downgrades, renewals, churn, delinquency, and MRR the same way Stripe does.

If you use HubSpot Payments or Stripe-as-a-Processor, then HubSpot becomes your billing source of truth, and everything (subscriptions, invoices, lifecycle events) lives natively inside your CRM.

Once you decide where the truth should live and the level of complexity that you need, every other decision (reporting, workflows, automation, customer visibility, forecasting) becomes dramatically easier to solve.