Why Finance Teams Struggle with MRR Visibility in HubSpot

If you're a finance leader at a SaaS company using HubSpot, you've likely hit this wall: your GTM teams live in HubSpot, but your subscription truth lives somewhere else, like Stripe, your accounting system, or a SaaS metrics platform like ChartMogul.

The result? Finance builds board decks in spreadsheets. Sales doesn't know which customers are actually growing. Customer success can't see expansion opportunities. And no one trusts the MRR numbers in HubSpot because they're manually entered, outdated, or just plain wrong.

The core problem isn't HubSpot, it's that HubSpot wasn't designed to be a subscription billing system. It's a CRM. And when you try to force billing logic (prorations, upgrades, downgrades, billing intervals, failed payments) into deal records, things break.

The good news is that you don't have to choose between finance-grade metrics and GTM team visibility. You just need the right integration architecture based on where your subscription data actually lives.

This guide will walk you through the decision framework finance teams use to get accurate, auditable MRR in HubSpot, without rebuilding your entire billing stack.

The Decision Framework: Where Does Your MRR Truth Live?

Before you evaluate tools, answer this question:

What system currently defines real MRR for your finance team? It could be…

Stripe: Your billing system calculates MRR based on active subscriptions

A SaaS metrics platform (ChartMogul, Baremetrics, ProfitWell): You've already invested in subscription analytics

Your accounting system (Xero, QuickBooks, NetSuite): Finance's source of truth is the general ledger and revenue schedules

HubSpot deals and spreadsheets: You're early-stage and modeling recurring revenue directly in the CRM

Your answer determines which integration pattern will work best.

Option 1: Stripe is Your Source of Truth

When This Applies

You're using Stripe as your billing system

Subscriptions in Stripe define what customers are actually paying

Finance needs to trust that HubSpot MRR matches Stripe and board reporting

You want GTM teams to have finance-grade numbers without Stripe access

The Challenge

Stripe tracks subscriptions at the product and plan level with granular pricing logic: prorations, billing intervals (monthly, annual, usage-based), discounts, credits, refunds, trials, and tax handling. If you try to manually sync this to HubSpot, you'll spend weeks building custom scripts and they'll break the moment billing logic changes.

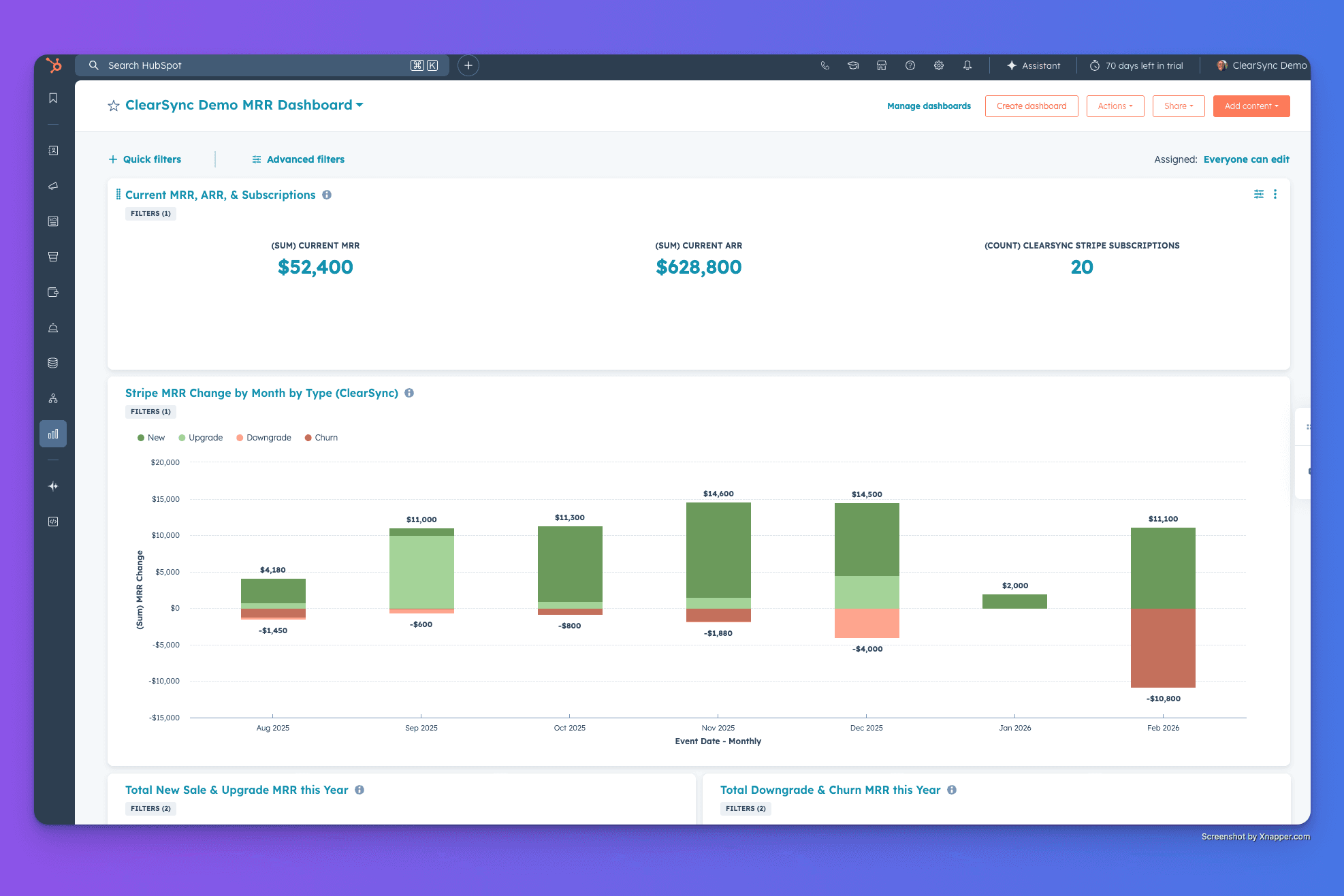

Best Solution: ClearSync (Stripe ↔ HubSpot MRR Integration)

What it does:

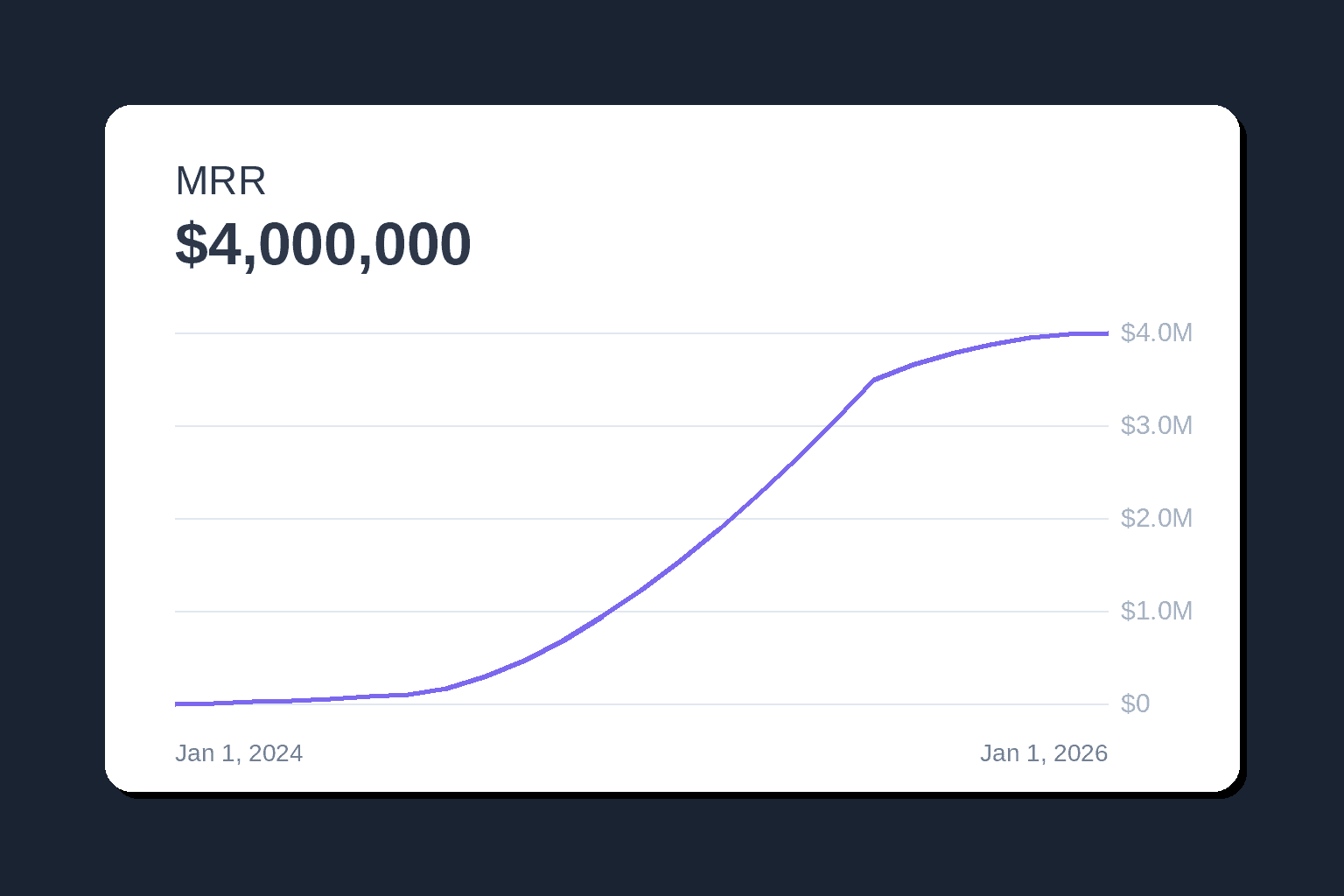

ClearSync is purpose-built to bring Stripe subscription and MRR data into HubSpot with MRR logic already built in. It syncs MRR, ARR, active products, billing intervals, and MRR change events (upgrades, downgrades, churns, reactivations) directly to HubSpot Company and Contact records.

Why finance teams choose it:

Automatic MRR calculation: Handles prorations, discounts, trials, refunds, and complex billing intervals automatically

Historical reconstruction: Imports 100% of Stripe subscription history, including churned and reactivated customers, so you can build cohort analyses and understand growth patterns

Date-stamped change events: Every upgrade, downgrade, churn, and reactivation is logged with timestamps, making MRR movement auditable

Real-time updates: Syncs as subscriptions change in Stripe, so HubSpot always reflects current state

Finance-grade accuracy: Your board deck MRR and HubSpot MRR are finally the same number

Use cases:

Run segment analyses in HubSpot to identify sources of new MRR or revenue leakage

Automate churn win-back campaigns based on Stripe cancellation data

Trigger expansion workflows when customers upgrade to higher-tier products

Give CSMs full billing context before customer calls

Best for:

Self-service or sales-led SaaS companies with Stripe as the billing system

Finance teams that need MRR accuracy without giving everyone Stripe access

Companies with multiple products, plans, or pricing tiers where manual syncing breaks down

Read-only access: ClearSync uses read-only Stripe permissions, so your billing data stays untouched.

Option 2: A SaaS Metrics Platform is Your Source of Truth

When This Applies

Finance and leadership already run off ChartMogul, Baremetrics, SaasGrid, or Paddle/ProfitWell dashboards

You've invested in a subscription analytics platform that consolidates data from Stripe, Chargebee, and other sources

You want HubSpot to reflect those metrics, not compute them

Near real-time sync isn't critical (daily updates are fine)

Best Solution: ChartMogul → HubSpot Integration

What it does:

ChartMogul's official "Pull SaaS Metrics" app syncs MRR, ARR, customer status, renewal dates, net payments, active plans, and SaaS cohort data into HubSpot Company records once per day.

Why finance teams choose it:

ChartMogul stays the source of truth: All MRR logic, corrections, and adjustments happen in ChartMogul

HubSpot becomes a consumption layer: GTM teams can segment, report, and build workflows based on trusted metrics

Investor-grade accuracy: If you're already using ChartMogul for board decks, this keeps HubSpot aligned

Best for:

Companies with multiple billing systems

Finance teams that need investor-grade metrics (MRR movement, churn cohorts, net revenue retention)

Companies that already use ChartMogul and want to extend visibility into HubSpot

Limitation: Syncs once per day, so HubSpot won't update in real-time as subscriptions change. If you need immediate updates for failed payment workflows or real-time expansion triggers, consider Stripe + ClearSync instead.

ChartMogul: Pull SaaS Metrics on HubSpot Marketplace →

Option 3: An Accounting System is Your Source of Truth

When This Applies

Finance's primary lens is the general ledger and revenue schedules

You need GAAP or ASC 606/IFRS 15 compliant revenue recognition

MRR/ARR accuracy must align with deferred revenue and recognized revenue

You're using Xero, QuickBooks, or NetSuite as your financial system of record

Best Solution: ScaleXP (HubSpot + Xero/QuickBooks + MRR)

What it does:

ScaleXP integrates HubSpot with Xero or QuickBooks and automates revenue recognition, MRR/ARR tracking, deferred revenue schedules, and financial forecasting. It pulls CRM data (Closed Won deals, contract terms) and accounting data together to provide a unified MRR/ARR view.

Why finance teams choose it:

Automated revenue recognition: Supports complex accounting standards for multi-element arrangements

Real-time financial dashboards: MRR, ARR, deferred revenue, and cash flow in one place

Audit-ready reporting: Generates compliant financial statements with drill-down to source transactions

Multi-currency support: Critical for international SaaS companies

Best for:

Companies where the CFO cares most about accounting accuracy and compliance

Teams that need MRR/ARR reporting and deferred revenue schedules in sync

SaaS companies with complex billing models requiring revenue recognition automation

Note: This is more "finance system with a HubSpot integration" than "HubSpot app for MRR."

Alternatives: Sage Intacct, Chargebee Rev Rec, Tabs

Other accounting-first platforms with HubSpot integrations:

Sage Intacct: Enterprise-grade revenue recognition with CRM sync

Chargebee: Subscription billing and revenue recognition with HubSpot connector

Tabs: Connects Stripe, NetSuite, QuickBooks for audit-ready revenue recognition reports

Option 4: HubSpot Deals Is Your Source of Truth

When This Applies

You're pre-$1M ARR with simple, predictable pricing

Most recurring revenue is modeled directly in HubSpot deals

You don't yet have structured subscription billing in Stripe or Chargebee

Finance wants "good enough" MRR/ARR visibility without adding another system

Best Solution: Dear Lucy (HubSpot Deals Reporting)

What it does:

Dear Lucy connects directly to HubSpot, reads deal and line-item data, and provides MRR/ARR dashboards, recurring vs. one-off revenue splits, and MRR forecasts with live updates.

Why finance teams choose it:

No external billing system required: Works with native HubSpot recurring revenue fields

Board-level dashboards: MRR/ARR by segment, rep, region, or product line

Fast implementation: If deal hygiene is clean, setup takes days, not weeks

Best for:

Early-stage or sales-led companies where deals accurately represent recurring revenue

Finance teams that want better MRR visibility but aren't ready for a full SaaS metrics stack

Companies that want to avoid adding ChartMogul or similar tools immediately

Limitation: Accuracy depends entirely on clean deal data. Once you have upgrades, downgrades, mid-term changes, or multiple products, you'll need subscription billing logic (Stripe + integration).

Important setup note: For clean MRR reporting in HubSpot, make sure fields like Unit Price, Billing Start Date, Term, Billing Frequency, and Quantity are consistently filled in. These are the foundations of accurate recurring revenue tracking.

Comparison Table: Which Solution Fits Your Stack?

Your Truth Lives In | Best Solution | MRR Sync Frequency | Best For | Handles Billing Complexity? |

|---|---|---|---|---|

Stripe | Real-time | Finance-grade MRR + GTM workflows | Yes (prorations, trials, discounts, intervals) | |

ChartMogul / Baremetrics | ChartMogul → HubSpot | Daily | Companies with investor-grade metrics in place | Yes (via ChartMogul) |

Xero / QuickBooks / NetSuite | Real-time | CFO-led teams needing rev rec + MRR | Yes (via accounting rules) | |

HubSpot Deals | Real-time | Early-stage with simple pricing | No (relies on deal hygiene) |

Next Steps

If you're ready to get finance-grade MRR in HubSpot:

Stripe users: Try ClearSync free for 14 days: we import historical Stripe data and sync all MRR data to HubSpot in real-time

ChartMogul users: Install the ChartMogul HubSpot integration

Accounting-first teams: Explore ScaleXP for rev rec + MRR

Early-stage teams using HubSpot Deals: Start with Dear Lucy and upgrade as you scale