A founder we spoke with (MIT grad, deeply technical) was manually tracking their Stripe MRR in a spreadsheet.

He's a smart guy. He could absolutely build the integration himself. He just knew better than to try.

Here's why.

Why Founders Start Down the DIY Path

You're at 20-30 customers. Stripe is handling billing beautifully. HubSpot is your CRM of choice. Everything's humming along.

Then someone asks: "Can we see subscription data in HubSpot?"

Seems reasonable. Your sales team wants to know when customers are up for renewal. Customer success needs to see expansion opportunities. Finance wants MRR reporting that matches what's in Stripe.

You ask ChatGPT: "How do I sync Stripe subscription data to HubSpot?"

The answer comes back confidently: "Use Zapier" or "HubSpot has a native Stripe sync" (here's how that might go) or "Just set up webhooks."

You look at the setup time and it’s maybe a few hours. You think: how hard could this be?

The Zapier Attempt And Why It Fails

One company we talked to went down exactly this path. They set up webhook triggers, mapped a few fields, and watched the data flow into HubSpot. It worked… for about two weeks. Then came the edge case.

A customer upgraded mid-cycle. The webhook fired: "something's been updated." Their Zap looked at the subscription object and updated the MRR field. Looks good, right?

Except the webhook didn't distinguish between a licensing change, a cancellation, a pause, or a status transition from "canceling" to "canceled." The integration updated the wrong field. Finance caught it two weeks later when the numbers didn't reconcile.

As they put it: "We don't ever want our revenue data to be wrong, not even once. There's all these weird edge cases. We're not Stripe developers. Let's not be Stripe developers."

Another founder built custom webhooks because they needed more control than Zapier offered. It worked better until it didn't. They spend seven minutes every morning manually double-checking renewal dates in HubSpot against what's actually in Stripe.

The problem? Stripe billing cycles don't equal contract renewal cycles. An annual contract paid monthly looks like a monthly subscription to Stripe. A three-year deal with annual invoicing has the wrong end date if you just pull the subscription period. Without custom metadata and transformation logic, you're constantly manually reconciling.

You can build the pipes. The transformation logic is where everything gets complicated.

When Multiple Accounts Enter the Picture

A nonprofit came to us with three Stripe accounts: two in Mexican pesos, one in USD for different business units. They'd tried HubSpot's native integration and Make. None of them could handle multiple Stripe accounts feeding into one HubSpot instance.

Their revenue team was fighting over whose numbers were right. The spreadsheet became the source of truth again.

This is the breaking point for most companies: 20-30 customers with actual complexity, usage-based billing components, multiple currencies, prorations on upgrades, failed payment retries. The simple webhook solution can't handle it.

The Transformations You Don't See Coming

Here's what it’s hard to foresee about syncing Stripe data to HubSpot:

Proration calculations. Customer upgrades mid-cycle from $50/month to $100/month. Stripe charges them $25 prorated for the remainder of the billing period. Is your current MRR $50, $100, or $75? The answer depends on how you want to report it and Stripe won't make that decision for you.

Failed payment logic. Customer's card fails on renewal and moves the Stripe status to “past due”. They update their card three days later and the Stripe status moves to “active”. Did they churn and reactivate? Or did they stay active the whole time? Your churn metrics depend on how you handle this, and a simple sync won't have an opinion.

Discount application. One-time discount versus recurring discount. Do you treat a one-time discount as a downgrade or ignore it? Do you count it as an upgrade when a recurring discount drops off? Your MRR calculations need to know the difference.

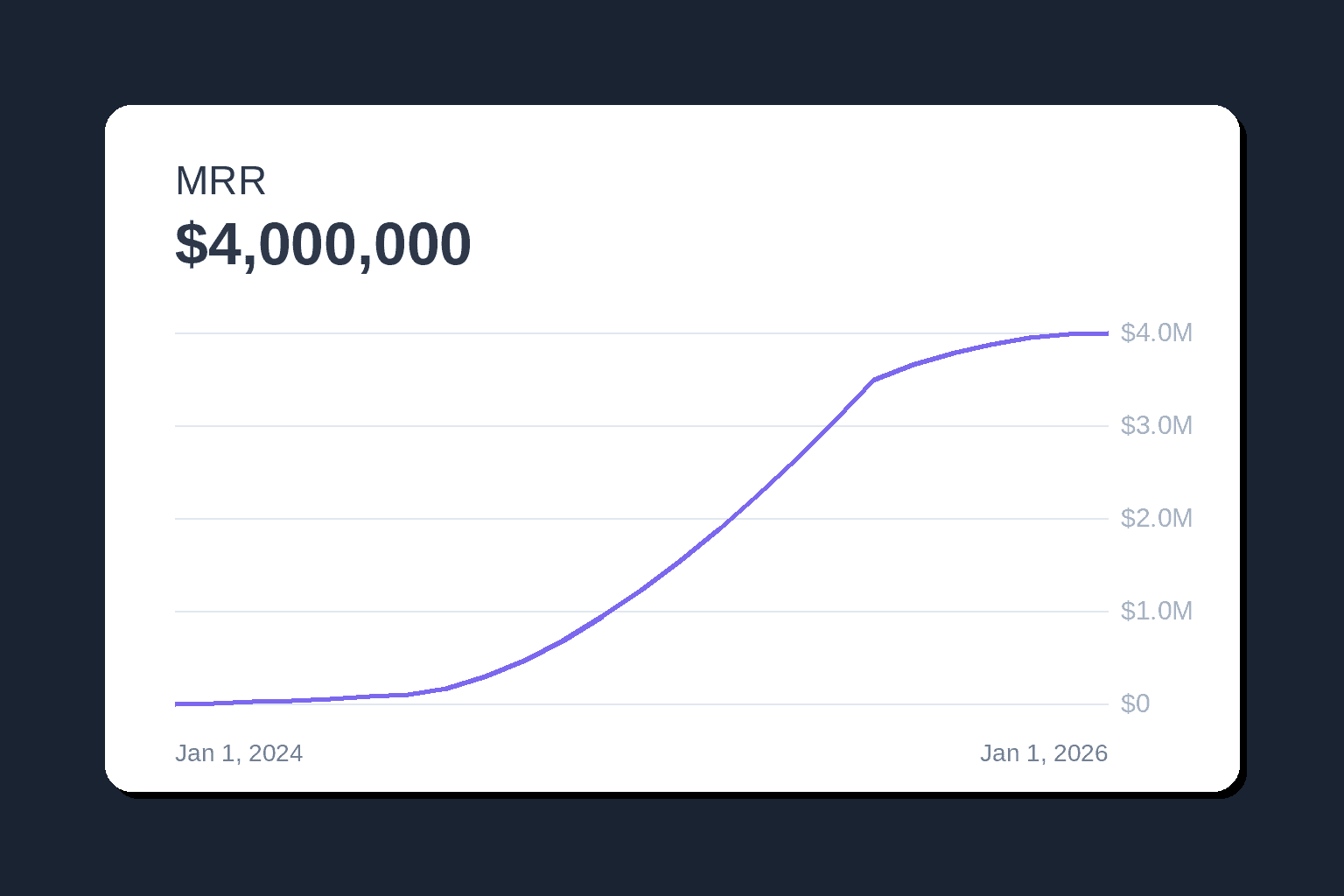

Historical reconstruction. You just set up the integration, but your CFO wants to see MRR trends for the past 18 months for the board deck. Stripe's API won't give you historical MRR snapshots. You'll need to replay every invoice, subscription change, and proration adjustment to reconstruct what MRR looked like on any given day.

Status transitions. A subscription goes from “trialing” to “active” to “past due” to “canceled”. Each status change means something different for revenue recognition. Your integration needs to understand the difference and update HubSpot accordingly.

Each of these feels like a "small thing" you can handle, until you're debugging webhook logic at midnight before your board meeting. (We dove deep into why MRR calculations are deceptively complex if you want to see just how many edge cases exist.)

What founders really want isn't just data sync. It's an opinionated back office that understands SaaS billing logic and makes the right decisions automatically.

When DIY Works And When It Doesn't

We're not here to tell you that every company needs a dedicated integration. Sometimes lightweight actually works.

DIY is fine if you are:

Single currency, with simple monthly or annual billing

Under 30 customers with predictable, low-complexity growth

Comfortable with manual reconciliation on a quarterly basis

Don't need workflow automation, just basic reporting

You need a purpose-built integration when:

Your billing has any complexity: usage-based components, seat-based pricing, hybrid models, or multi-currency

Your team needs HubSpot workflows triggered by subscription events, not just reports

Historical context matters for your business (seeing that a customer upgraded three times before churning tells you something)

Engineering time is expensive and you'd rather have your developers build product than maintain billing infrastructure

You can't afford to be wrong on revenue numbers even once

What We Built Instead

We built ClearSync because we lived this exact journey at previous companies. The insight: "just sync Stripe to HubSpot" is simple in theory, complex in practice.

If you're still in the DIY phase with simple billing, you might not need more than basic webhooks and some manual reconciliation. But if you recognize yourself in any of these stories—spending mornings double-checking dates, debugging webhook edge cases, or refereeing arguments about whose numbers are right—you're probably past the point where lightweight solutions work.

That's when purpose-built integrations start making sense. They handle the edge cases, have opinions about proration logic and failed payments, and reconstruct historical data accurately. They're designed for the messy reality of SaaS billing, have opinions, and account for edge cases.

If you're ready to move past DIY, start a free trial or schedule a demo to see how ClearSync handles the complexity.